LINK Price Eyes $50 Surge After Chainlink Endgame Release

Chainlink (LINK) is making waves again. After months of accumulation by whales and the release of its ambitious Endgame vision, LINK has surged to its highest level since January — and technical indicators suggest the rally may just be getting started.

📈 LINK Price Surges 165% — Smart Money Is All In

As of this week, LINK hit $28.85, marking a 165% increase from its yearly low. Its 24-hour trading volume spiked to $2.9 billion, while market cap reached $17.5 billion. According to Nansen, LINK was the most purchased token by smart money investors in the past 24 hours, with over $1.5 million in buys.

Whale wallets have also ramped up their holdings — increasing by 66% in the last 30 days to 5.49 million LINK. That’s a strong vote of confidence from deep-pocketed investors.

📜 Chainlink Endgame: A Vision for Trillions in Transactions

The biggest catalyst? The release of the Chainlink Endgame — a comprehensive roadmap positioning Chainlink as the industry-standard oracle platform. The document compares Chainlink’s role in blockchain to what Windows did for PCs, iOS for mobile, and AWS for cloud computing.

Chainlink aims to power trillions of dollars in transactions across:

Real estate

Debt markets

Stocks and derivatives

Cross-border payments

It’s already working with giants like UBS, SWIFT, ANZ Bank, and Fidelity to enable cross-chain settlements of CBDCs, stablecoins, and tokenized assets.

💰 Strategic LINK Reserves Fuel Long-Term Demand

Chainlink has also launched the Strategic LINK Reserves, a mechanism that channels both on-chain and off-chain revenue into LINK accumulation. Over $2.8 million worth of LINK has already been purchased — and this reserve is designed to grow perpetually.

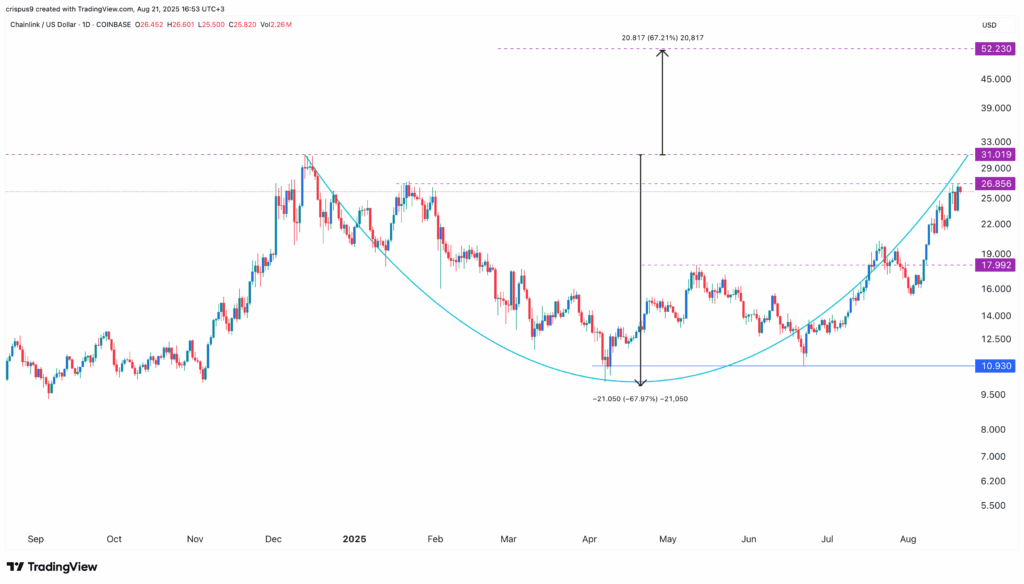

📊 Technical Setup Points to $52 Target

The daily chart shows LINK entering the third wave of the Elliott Wave pattern, historically the most bullish phase. It’s also forming a cup-and-handle pattern with a depth of 67% — projecting a potential breakout to $52.

With LINK trading above its 50-day and 100-day moving averages, the technical foundation remains solid.

🧨 ETF Speculation Adds Fuel

Rumors are swirling that a firm may soon file for a spot LINK ETF with the SEC. If approved, it could open the floodgates for institutional investment — further accelerating LINK’s upward trajectory.